34+ can i write off mortgage interest

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. First you must separate qualified mortgage interest from personal.

Lot 34 Chinquapin Ln Morgan Hill Ca 95037 Mls Ml81917807 Zillow

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

. Ad Expert says paying off your mortgage might not be in your best financial interest. From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to. Above 109000 54500 if.

That cap includes your existing. However higher limitations 1 million 500000 if married. Ad Chat Online Right Now with a Tax Expert and Get Info About Tax-Deductible Donations.

Web Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing separately. You may still be able to. For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000.

Lets say you paid 10000 in mortgage interest and are. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000. Web How Much Mortgage Interest Can I Deduct.

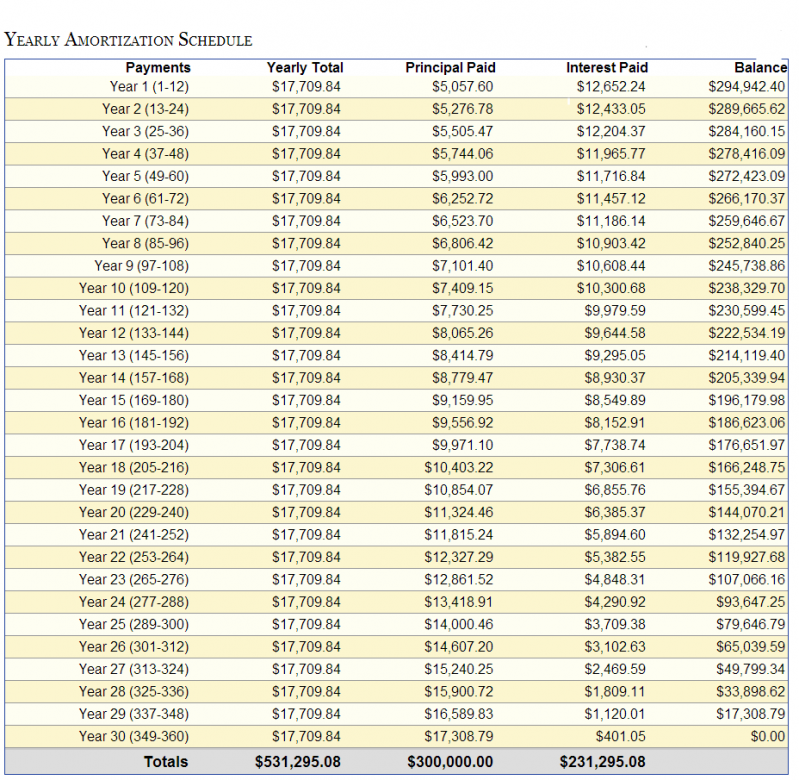

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web For new mortgages issued after Dec.

Web Up to 96 cash back You can fully deduct most interest paid on home mortgages if all the requirements are met. However households who use. Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately.

If you took out your home loan before. Web Most homeowners can deduct all of their mortgage interest. 15 2017 taxpayers can deduct interest on a total of 750000 of debt for a first and second home.

Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay. Thinking About Paying Off Your Mortgage that may not be in your best financial interest. Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million.

Ask a Tax Expert for Info Now About How to Write-Off Mortgage Interest in a Private Chat. Web Mortgage Interest Tax Deduction Limit. Web Since it isnt legal to just claim back your mortgage interest on a primary residency most homeowners dont and shouldnt do it.

Web The tax benefit for mortgage interest deductions will be 750000 for this years tax year which means a home buyer will be able to deduct the interest paid on up. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Free 34 Loan Agreement Forms In Pdf Ms Word

Blue Ridge Realty High Country Real Estate Listings Summer 2019 By Blue Ridge Realty Investments Issuu

Mortgage Interest Deduction Bankrate

How To Test Banking Domain Applications A Complete Bfsi Testing Guide

Free 34 Loan Agreement Forms In Pdf Ms Word

How To Pay Off A 30 Year Mortgage In 15 Years Debt Org

Mortgage Interest Tax Deduction 2022 What If You Forget

Mortgage Interest Deduction Bankrate

34 Payment Schedule Templates Word Excel Pdf

Should I Pay Off My Mortgage Early Saverocity Finance

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Mortgage Statement 10 Examples Format Pdf Examples

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Sold 1869 Penfield Walworth Road Walworth Ny 14568 Walworth 3 Beds 2 Full Baths 265 000

Tattyreagh Bailieborough Co Cavan A82 W0d7 Keenan Auctioneers Leading Estate Agents In Cavan

Maximum Mortgage Tax Deduction Benefit Depends On Income

Best Real Estate Tax Tips